CT’s Tax Freedom Day is April 25th!

Posted on April 22, 2019

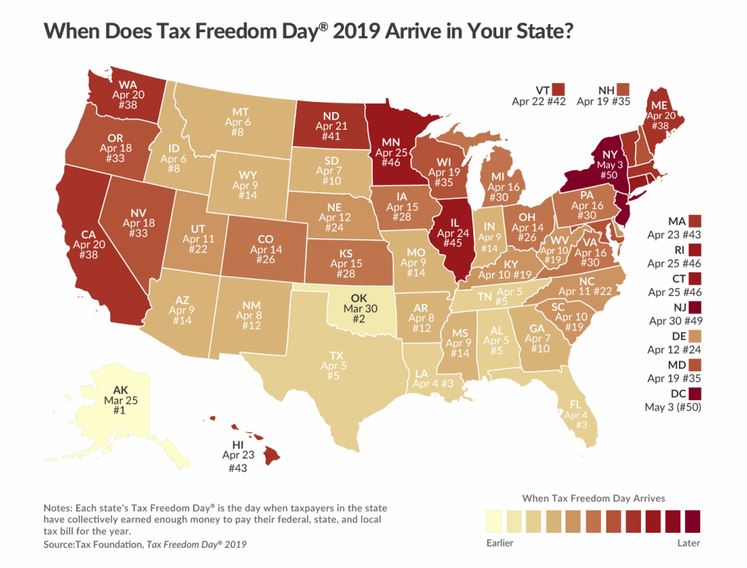

Once again, Connecticut’s tax burden is among the highest of any state in the nation. Residents in our state need to work longer than residents in 45 other states to pay their local, state and federal tax bills.

Tax Freedom Day is the day each year when the average citizen has earned enough to pay their combined local, state and federal tax bills. National Tax Freedom Day is on April 16!

This year, according to The Tax Foundation, Connecticut’s Tax Freedom Day is April 25, which means we’re tied for 46th place with Minnesota and Rhode Island. Only New York, New Jersey and Washington D.C. residents have to pay more to cover their obligations.

To put it in perspective, most of us will spend more on taxes in 2019 than we will on food, clothing and housing, combined. In more practical terms, YOU essentially work for the local, state and federal government for almost five months before you can begin paying your own bills and providing for your family.

Adding to this terrible news, Governor Lamont and the Democrats have proposed new taxes on sugar-sweetened drinks, plastic bags, youth sports, parking, haircuts, trash collection, home renovations and remodeling, laundromat and dry cleaning services, veterinarian services, and they have pushed for an end to the annual tax-free “Back to School” shopping week. They also plan to eliminate tax exemptions on over-the-counter medicine, vegetable seeds, car seats, bicycle helmets, textbooks and much more.

If we can take any good news from this awful report it is that recent changes in federal tax law, the Tax Cuts and Jobs Act, have been largely responsible for making 2018 and 2019’s Tax Freedom Day five days earlier than it was in 2017. Still, that’s a small measure of comfort for those of us who struggle to keep our spending in check and live within our means.

Connecticut can do better.