Posted on March 28, 2024

![]() It’s Opening Day! Are you ready to pay more to watch Red Sox and Yankees baseball? You will through a proposal (H.B. 5446) pushed by Democrats, who want to expand a tax that could not only affect your favorite streaming services such as Netflix and Disney+, but also baseball-focused broadcasters NESN and YES.

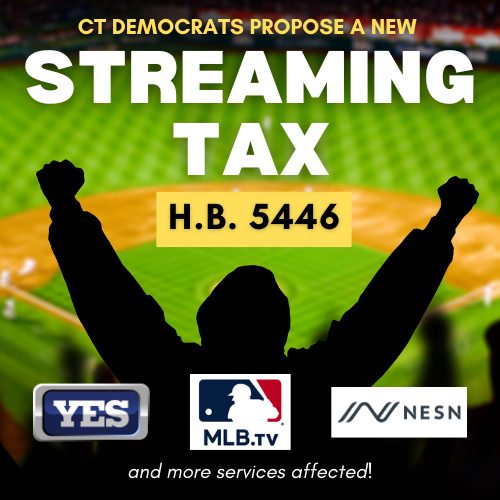

It’s Opening Day! Are you ready to pay more to watch Red Sox and Yankees baseball? You will through a proposal (H.B. 5446) pushed by Democrats, who want to expand a tax that could not only affect your favorite streaming services such as Netflix and Disney+, but also baseball-focused broadcasters NESN and YES.

The proposal was advanced recently by Democrats on the Energy and Technology Committee, of which I am a member. This tax initiative would penalize residents in Connecticut who have made strides…

Posted on March 25, 2024

Today on the floor of the House of Representatives, I took a moment to remember Ed McCarthy, who passed away on March 10th. Coach McCarthy will be remembered in his native West Haven and at St. Joseph’s High School for his immeasurable contributions as a football coach. His impact on countless lives as a teacher and mentor will never be lost on the communities he touched. The House took a moment of silence to honor his memory.

Posted on March 11, 2024

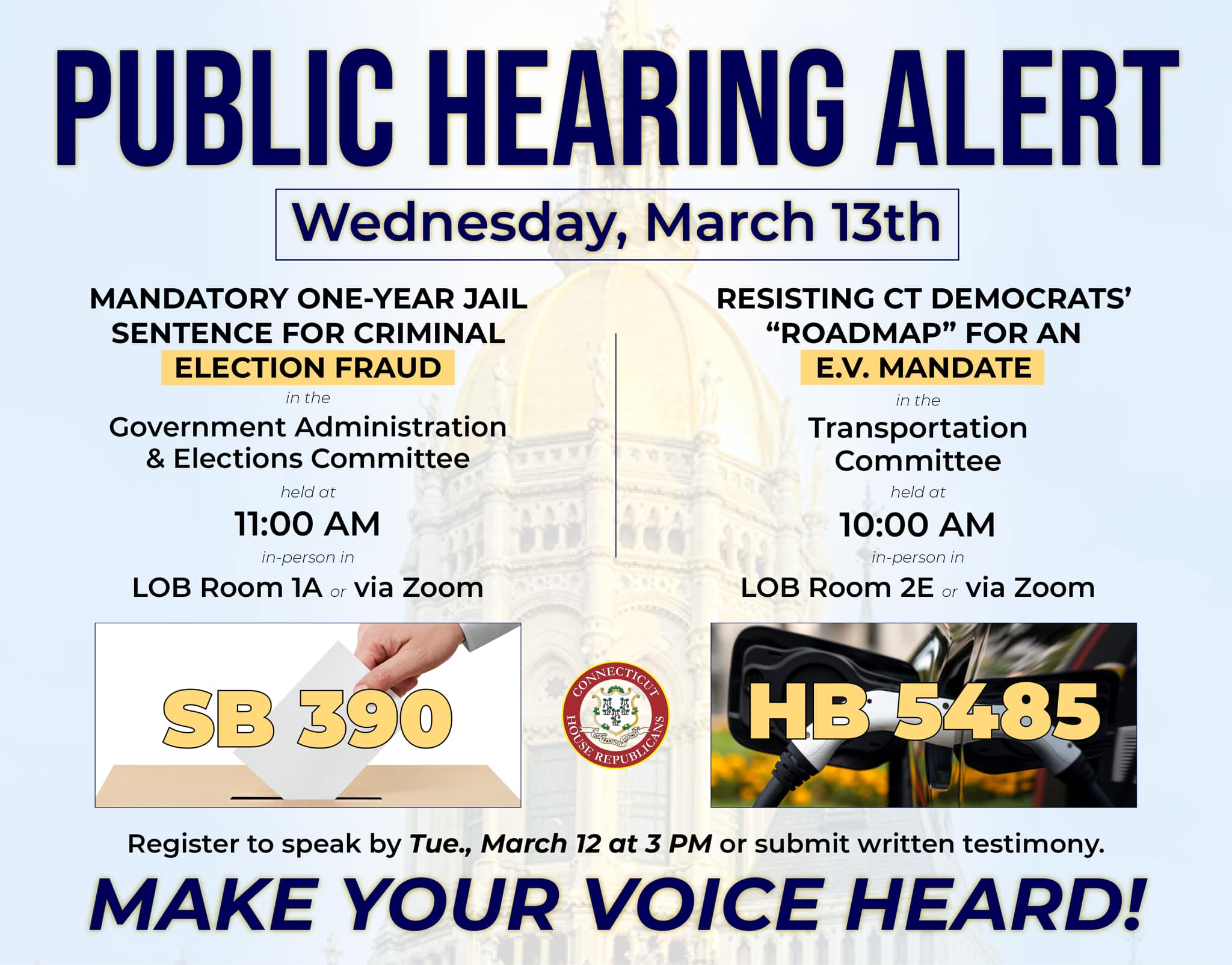

This Wednesday, there will be two important public hearings debating key issues in Connecticut. I encourage you to register to speak or submit testimony.

![]() ELECTION SECURITY: With cases of fraud Bridgeport putting Connecticut’s elections on the national stage, it is overdue to sure up the integrity of our state’s elections. House Republicans’ proposal – SB 390 – is a mandatory one-year jail sentence for anyone convicted of criminal election law violations.

ELECTION SECURITY: With cases of fraud Bridgeport putting Connecticut’s elections on the national stage, it is overdue to sure up the integrity of our state’s elections. House Republicans’ proposal – SB 390 – is a mandatory one-year jail sentence for anyone convicted of criminal election law violations.

![]() Register to speak: https://tinyurl.com/mr2575m5…

Register to speak: https://tinyurl.com/mr2575m5…