Posted on April 25, 2024

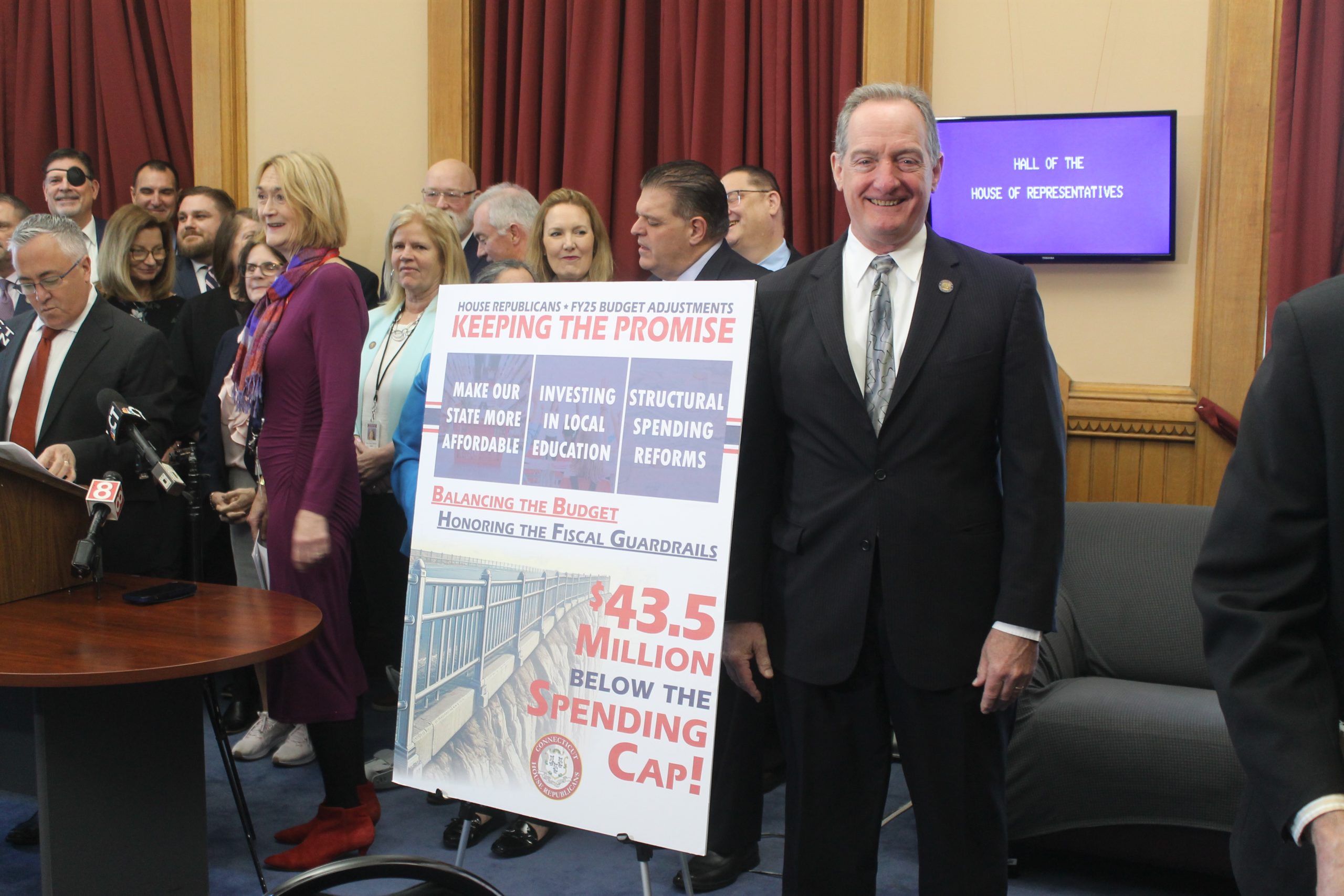

I joined my colleagues to present our 2024 budget adjustments at the State Capitol during a news conference on Thursday morning. This budget prioritizes spending, creates structural reforms, and comes in $43.5 million under the established spending cap.

To view the news conference, click the image below.

|

Promises Kept… |

|

In addition to maintaining spending and borrowing caps that have kept our state solvent, the budget plan focuses on supporting children at the beginning of their educational… |

Posted on April 19, 2024

HARTFORD – The House was in session on Wednesday, April 17, and Thursday, April 18. To review all of the legislation that was considered please click on the corresponding date and you will be provided with the House Journal.

On Wednesday, students enrolled in UConn’s 4-H program came to visit the capitol. This program is important for individuals who are interested in growing a career in agriculture. Rep. Piscopo had the opportunity to meet with enrollees and learn more about their course of studies.…

Posted on April 8, 2024

April is World Autism Month. Join us in spreading awareness about Autism Spectrum Disorder (ASD), what resources are available, and to dismantle negative stigma that can be associated with it. Our caucus will continue to strive to craft policies, similar to P.A. 23-137 that eliminated wait lists for services and expanded autism Medicaid waivers, that promote a more inclusive society.

Resources available:

>>>DPH, Connecticut Collaborative to Improve Autism Services (Click Here)

>>>DSS, Autism Spectrum…

Posted on March 28, 2024

BURLINGTON – State Rep. John Piscopo (R-76) was invited to the Cub Scouts Pack 23 meeting recently to talk to them about their state government. One of the requirements the scouts have is to meet with one of their elected public officials. Piscopo attended the meeting to provide an overview of the General Assembly, explain how bills become laws, and to host a mock debate about the issues impacting the scouts’ community.

“One of the best parts of my job is meeting with students and scouts who are…

Posted on March 21, 2024

HARTFORD – State Representative John Piscopo (R-76) participated in “Agriculture Day” on Wednesday, March 20. Future Farmers of America chapters throughout Connecticut visit the Capitol Complex to meet with lawmakers and to share their Vo-Ag program experiences. As a member of the legislature’s Environment Committee, Piscopo understands the importance of Vo-Ag programs. “It’s critical that Connecticut students are able to explore careers within the state’s growing agriculture industry. Traditional…

Posted on March 18, 2024

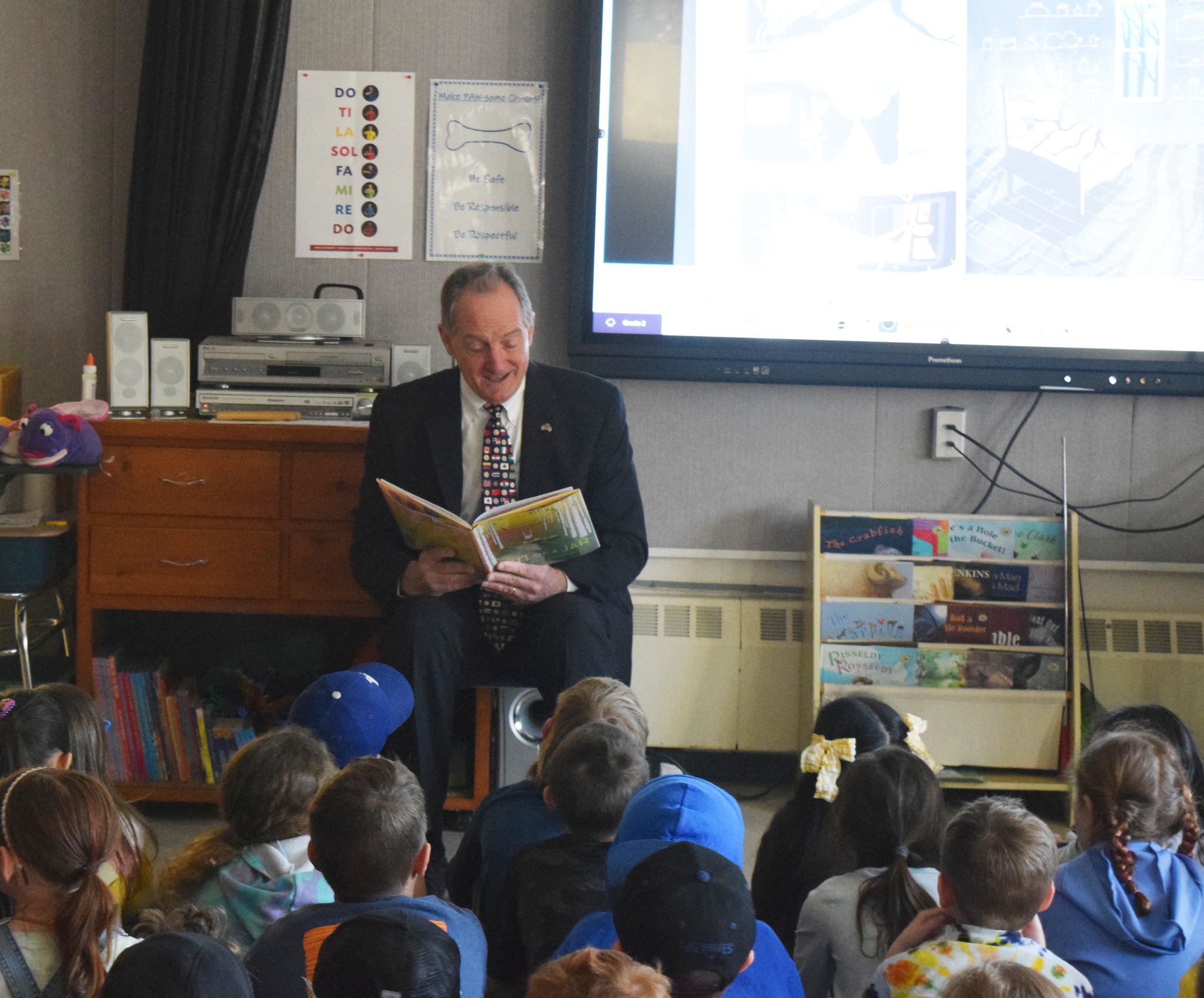

HARWINTON – Read Across America took place at Harwinton Consolidated School. State Representative John Piscopo (R-76) visited students and read Deborah Marcero’s ‘Out of a Jar.’ The story does a masterful job of breaking down the importance of sharing emotions and not hiding your feelings from family and friends. “I had an enriching experience reading this story to the students in Harwinton. They were engaged and asked me great questions after we finished the book. I look forward to visiting them…

Posted on March 4, 2024

Hartford – State Rep. John Piscopo (R-Thomaston) testified before the Judiciary Committee on Monday afternoon in support of legislation speaking to the operations of private campgrounds. The legislation seeks to provide a clear understanding to those utilizing private campgrounds of the inherent risks involved with recreating in an outdoor environment.

“We really just want to clarify the responsibility of certain parties in the event someone gets hurt on a private campground,” said Piscopo. “We want…

Posted on February 26, 2024

Photos by Jo-Ann Iannotti

GOSHEN – State lawmakers, including State Rep. John Piscopo (R-76), took the opportunity on Saturday morning to meet with members of the public and engage in a policy discussion at Camp Cochipianee. The event was hosted and facilitated by the League of Women Voters of Litchfield.

“I appreciated the discussion between my fellow participants of the panel, which included lawmakers from both sides of the aisle, and those who were able to attend the breakfast. We covered an…

Posted on February 26, 2024

Hartford – Republicans unveiled several ways in which the state can begin to address the rate hike adjustment proposals that have recently been requested by Connecticut’s energy utilities. These rate hikes come at time when residents and businesses are facing record-setting levels of inflation.

You can watch the news conference by clicking here.

The proposals aim to:

- limit all future Power Purchase Agreements so that no contract can be for more than 100% over the wholesale electric market price

…

Posted on February 22, 2024

Litchfield – State Rep. John Piscopo joined his colleague, State Rep. Karen Reddington-Hughes, in participating in the Northfield Fire House pancake breakfast on Sunday, February 17, in support of Patti Kelley. The state lawmakers were also joined by Litchfield Selectman John Bongiorno. “As always, Litchfield came out to support a great cause. We had a great breakfast and it’s always appreciated what our volunteers do at the fire house. Their service to our community goes above and beyond what is…