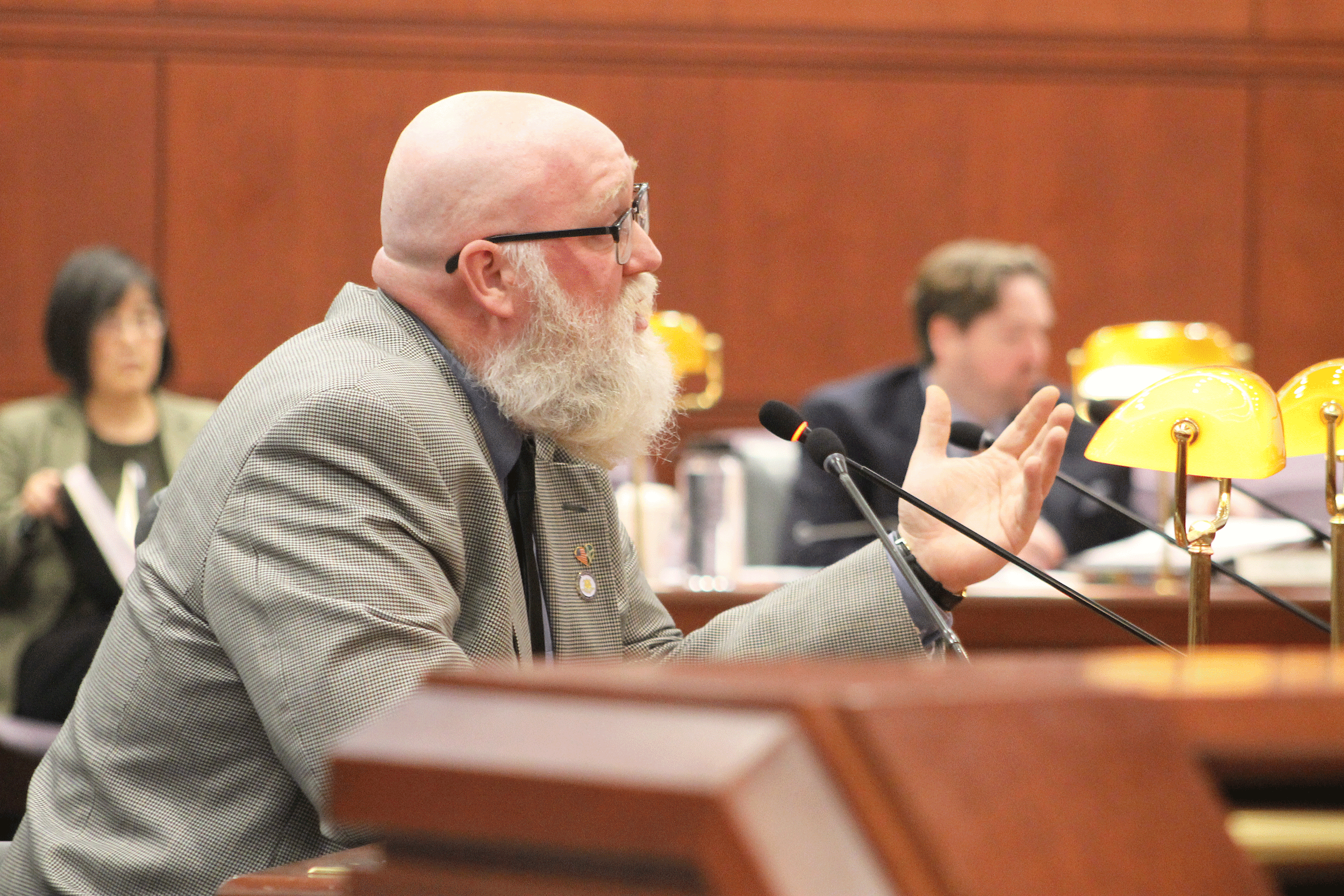

Rep. Buckbee Introduces Job Expansion Initiative

Posted on March 4, 2019

HARTFORD – State Rep. Bill Buckbee (R-New Milford) put forth a legislative proposal that would expand jobs and help increase the membership of the state’s workforce by incentivizing businesses to hire full-time employees. In the event that a business does employ a full-time, new hire, that business will be eligible for a tax credit.

“I believe the creation of a job expansion tax credit and program to be necessary to help our state’s employers by offering incentives for the hiring and retention of new employees. Providing Connecticut’s workforce with more full-time job opportunities would better assist our citizens, their families and the economy within Connecticut. This tax credit would afford businesses the opportunity to take on more employees than they would have considered previous to the creation of this tax credit,” explained Rep. Buckbee.

According to Rep. Buckbee, from 2012-2015, a similar tax credit incentive was responsible for helping create roughly 7,550 jobs. In this time frame 848 (employer) applicants were approved to receive a tax credit.

Rep. Buckbee went on to say, “Providing an employer with a 2.5% tax credit would better encourage a business to consider hiring a veteran or unemployed applicant. Should the business hire a previously employed non-veteran, I believe a credit of 2% to be acceptable.”

Rep. Buckbee had previously proposed a tax credit that was a static dollar amount. However, with this initiative calling for a percentage to be tied to the new hire’s salary, a company could see a greater return on larger investments – like filling higher paying positions.

To review Rep. Buckbee’s testimony, please click here.

The Finance Committee will review the concept over the coming weeks. The committee’s next action would be to move the concept to the House of Representatives for its consideration of the bill.

###