Connecticut residents must work until April 25th, longer than the residents of 45 other states, to pay off their federal, state, and local tax bills. In recent years Connecticut has seen skyrocketing revenues from digital downloads and other consumption taxes. Despite this, Legislative Democrats in Hartford continue to push new revenue sources.

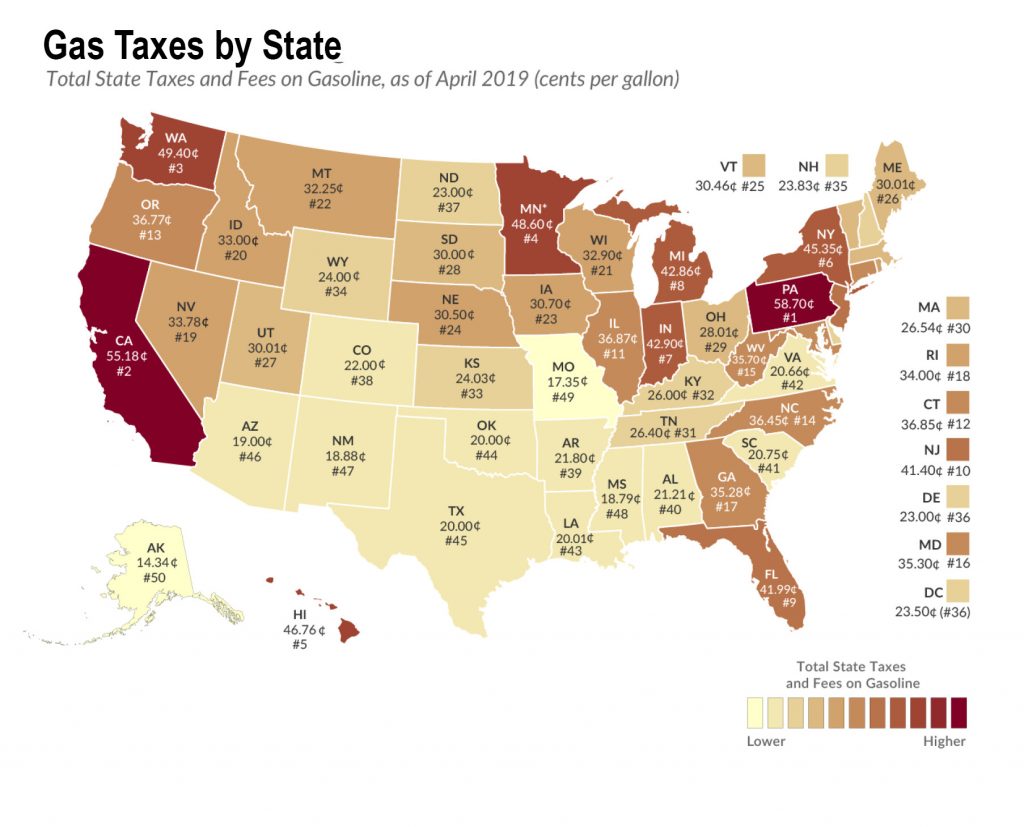

The Transportation Climate Initiative (TCI) will create a new tax on gasoline and diesel, by forcing private fuel wholesalers to purchase carbon offsets. Distributors will pass on these costs leaving families and businesses paying more in an already expensive state.

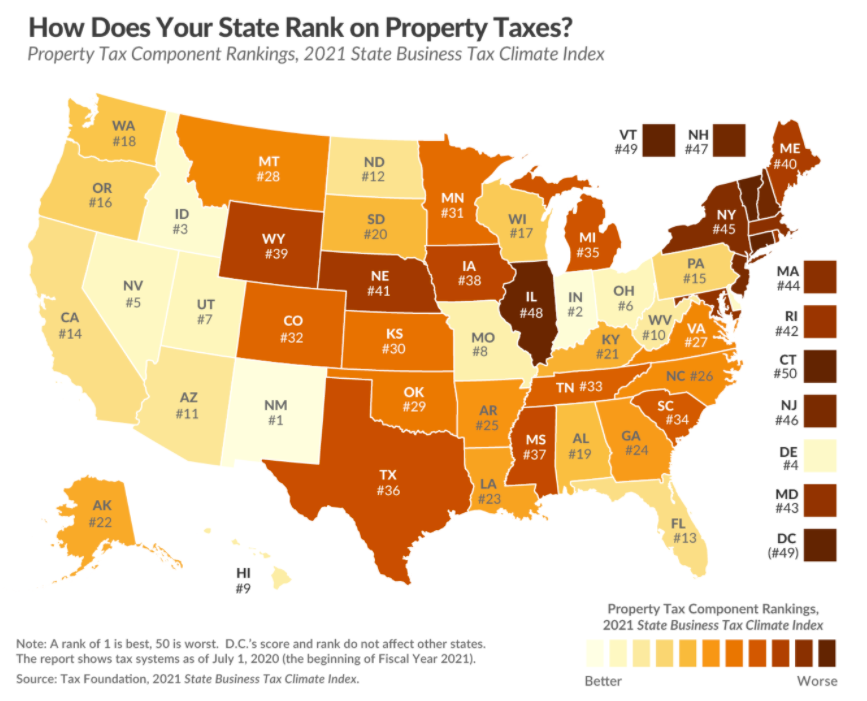

Connecticut already has some of the highest property taxes in the Country. Yet, Legislative Democrats in Hartford have proposed a bill that would levy as much as two mills on top of local tax rates.

In addition to a fuel tax, a mileage tax on trucks has been proposed. Again, this will increase the cost of everything from groceries to household essentials.