"*" indicates required fields

Rep. Scott Supports Bipartisan Budget Plan

Posted on June 6, 2023

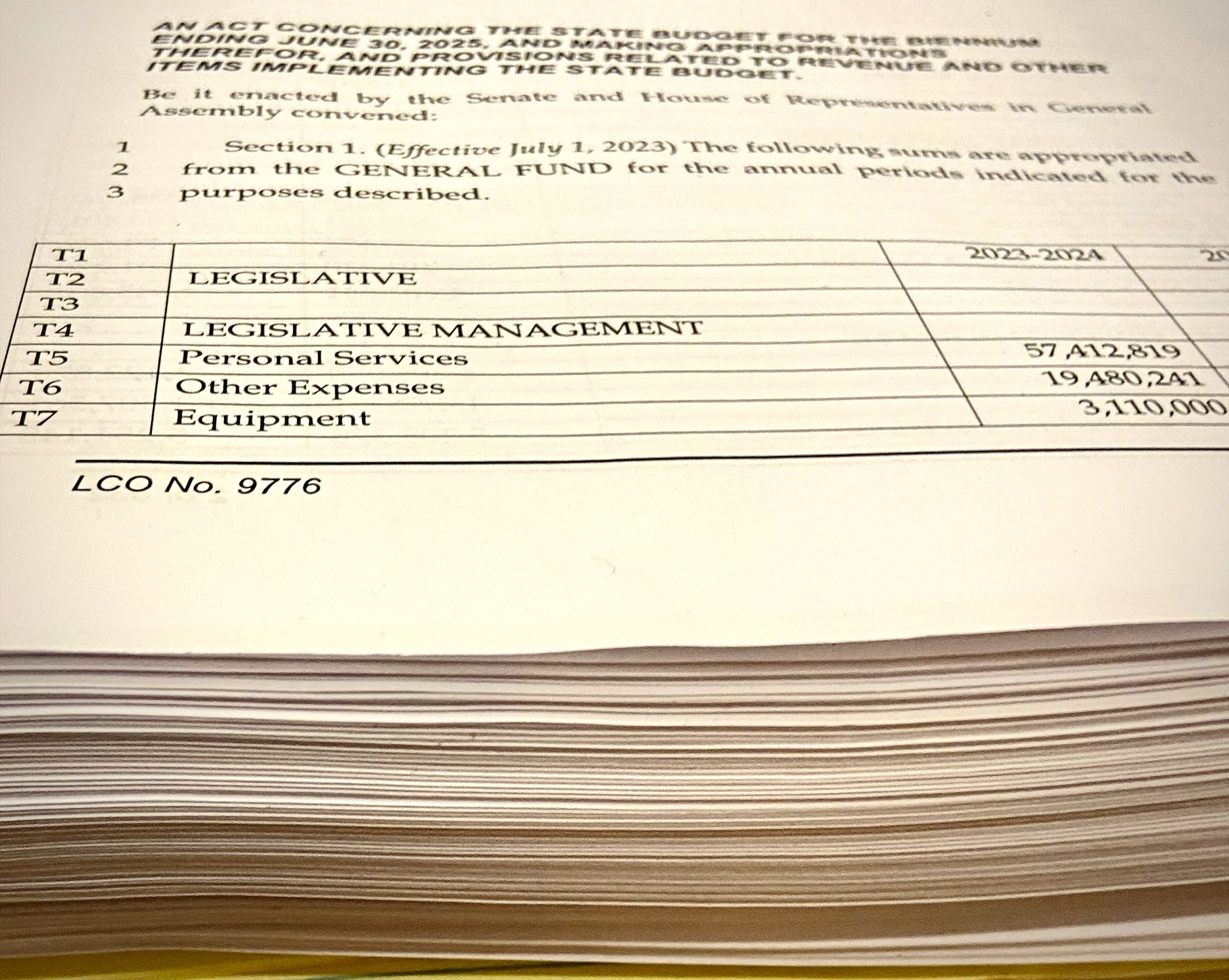

Hartford—The House approved a two-year, $51 billion budget plan on a vote of 139-12. Among the highlights of this plan is a reduction of the income tax from 5% to 4.50% and 3% to 2%. The budget also increases the Earned Income Tax Credit for working families from 30.5% to 40%.

“I voted for this bipartisan budget because of the tax relief for families. We also fought for more funding for nonprofits. I’m pleased that the Democrats and the Governor chose to adopt the rate House Republicans proposed of 2.5%,” said Rep. Tony Scott (R-112).

The budget plan invests $150 million in education funding to implement a portion of HB 5003, revising how public education is funded in the state. The plan fully funds the Excess Cost grants for special education reimbursements to towns. It also caps tuition payments to magnet and vocational agriculture operators at 58% of the amount paid per student in FY 24.

“This budget also stays within the spending cap and adheres to other fiscal guardrails put in place in 2017, which have led to surpluses allowing us to be able to offer tax relief now. This plan also slims down state government by adopting real-world hiring methods and hiring assumptions,” added Scott.

- Provide additional funding for homeless shelters

- Increase the tiered PILOT for towns and allocates an additional $18.9M in revenue to most towns

- Eliminate the benefits cliff by phasing out the income tax exemption for pension & annuity income and individual retirement accounts

- Freeze the diesel tax at 49.2 cents per gallon for one year and won’t be recalculated per statue by the Department of Revenue Services effective in FY 24