Plan would triple maximum credit to $1,000 and offer more relief to 800,000+ residents as Democrats prepare to divert surplus to government funds

Key Takeaways

- Lawmakers propose middle-class property tax cuts to reduce the burden on Connecticut's homeowners

- Connecticut House Republicans propose targeted relief to lower residential tax bills

- Proposal includes exemptions/credits for qualifying middle-income homeowners

- Will provide relief & improve affordability while shielding families from tax hikes

We want to hear from you!

We know property taxes are squeezing Connecticut’s middle class. That’s why House Republicans proposed a historic expansion of the state’s property tax credit. If you’re grappling with rising costs, we want to hear your story.

CLICK HERE TO RECORD A VIDEO AND ADD YOUR VOICE!

HARTFORD—House Republicans on Tuesday proposed the largest expansion of Connecticut's property tax credit in state history, increasing the maximum credit to $1,000 and growing eligibility for additional relief to more than 800,000 residents.

House Republicans outlined their plan at a Legislative Office Building news conference, joined by municipal officials whose constituents face financial pressure from property tax hikes driven by revaluation. House Republican Leader Vincent Candelora (R-North Branford) and his caucus developed the middle-class tax relief plan after Democrats announced they would raid $500 million in state surplus funds during an anticipated November special session for an off-budget fund to prepare for the speculated impact of federal funding changes that won't be fully understood until next year.

"Property taxes driven by revaluation are crushing Connecticut's middle class, yet our Democratic colleagues ignore this crisis while pushing policies that increase costs—from higher electric bills to unfunded mandates that drive up local taxes," Candelora said. "The treasurer is delaying transfer of $1.9 billion in volatile revenue beyond the $4.3 billion Rainy Day Fund so Democrats in the legislature can redirect it into a slush fund. That's unacceptable. If they won't use that money for pension debt—the primary purpose for volatile revenue—it should go back to taxpayers. When people see the size of our reserves, they understandably feel overtaxed. They're right. This isn't the Democrats' money to intercept through an opaque process—it belongs to taxpayers."

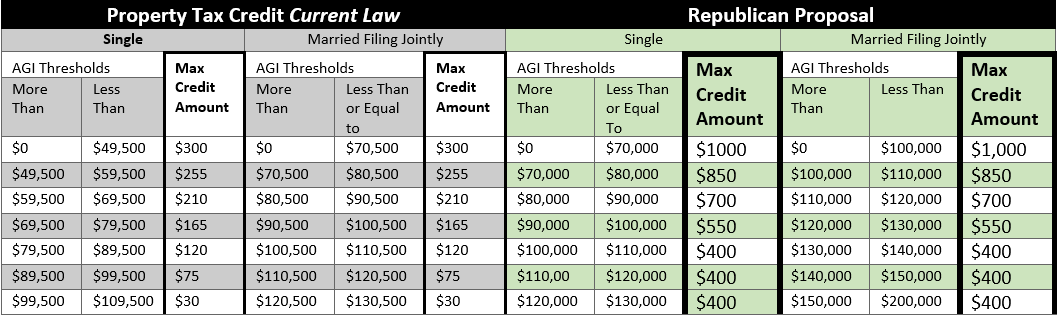

Under the Republican plan, every qualifying taxpayer would see an increase in their credit. The proposal raises the maximum credit from $300 to $1,000 and sets a minimum credit of $400 for eligible filers. It also increases income eligibility thresholds by about $20,000 for single filers and $30,000 for joint filers. The plan particularly benefits joint filers by raising the eligibility threshold from $130,500 to $200,000. Under current law, thousands of these filers receive only the minimum $30 credit—or nothing at all. Overall, more than 800,000 filers would see more relief.

The Republican tax relief plan would use $501 million from the $1.9 billion in volatile revenue that’s targeted by Democrats who are plotting yet another off-budget fund.

"Republicans pushed for fiscal guardrails to create financial stability, and it’s led to a $4 billion reserve that can help address unexpected situations as they arise. But Democrats would rather create a new government fund they control rather than trust the systems already in place,” said Rep. Joe Polletta (R-Watertown), House Ranking member of the Finance Committee. “Our plan is straightforward: take that same money and put it toward the largest property tax credit expansion in state history. More than 800,000 filers would see more relief—some for the first time. That's how you help people, not by speculating about what might happen down the road and using fear as an excuse to grab money now."

The $700 increase to the maximum property tax credit offered by Republicans contrasts sharply with Governor Lamont's 2025 proposal—a $50 increase that was ultimately ignored by Democrats in their final $55 billion two-year budget adopted in June.

Republican lawmakers were joined by Bristol Mayor Jeff Caggiano, Wallingford Mayor Vincent Cervoni, and Seymour First Selectwoman Annemarie Drugonis, who spoke about taxpayer challenges driven by revaluation.

"We're appreciative that Republican lawmakers are focusing on property taxes," said Caggiano said. "Residents in communities throughout the state are seeing higher taxes not because of reckless spending or expanding local government, but because of sharp increases in property values that are out of everyone's control."

"Property revaluation has put tremendous pressure on our taxpayers through no fault of their own," Cervoni said. "These aren't tax increases driven by municipal budgets—they're driven by market forces beyond our control, and residents need relief."

"Our residents are being squeezed by rising property values that have nothing to do with how we manage our town," Drugonis said. "This Republican proposal recognizes that middle-class families need help dealing with property tax bills that keep climbing despite responsible local governance."