Connecticut Among Nation’s Top ‘Cost of Doing Business’ States

Posted on July 12, 2023

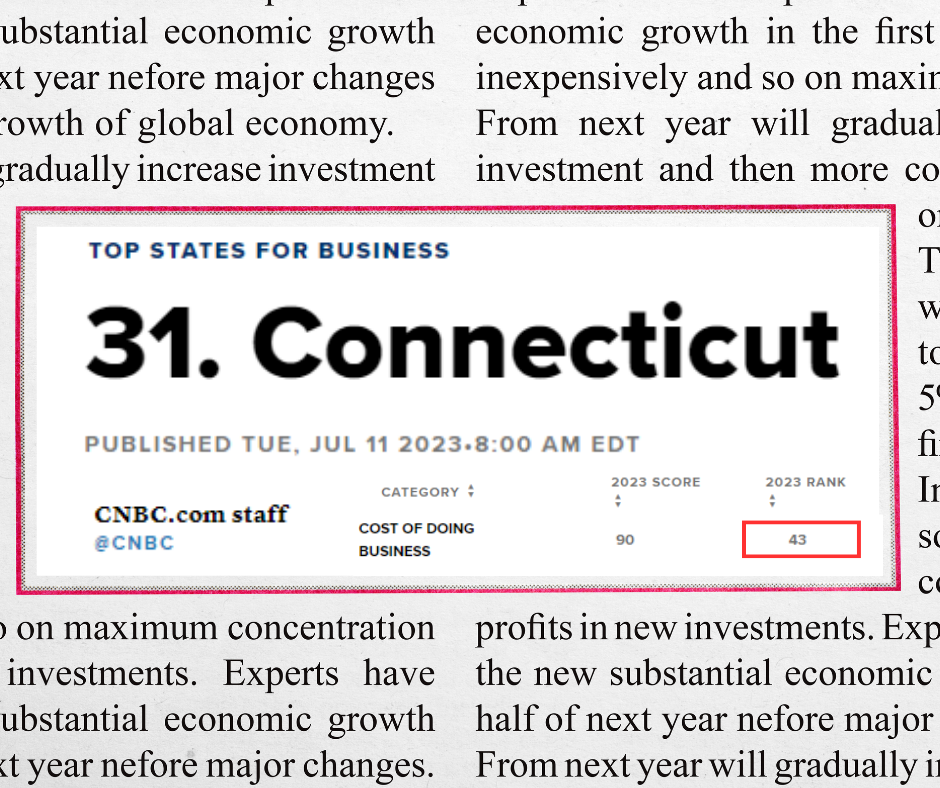

Connecticut Democrats are touting the passage of the current state budget as a major win for our state. Unfortunately, the reality of the state’s economy paints a more dire picture for our businesses and residents. CNBC recently released its rankings of America’s Top States for Business, ranking Connecticut at number 31 overall, and at number 43 for cost of doing business. [1] With a relatively higher cost of doing business, attracting entrepreneurs and job creators is an arduous task.

Earlier in the year, I proposed a concept for the legislature to repeal the ‘Highway Use Tax’ – a mileage fee, paid by truckers, for using the state’s highways to deliver goods. In turn, this drives the cost higher for the end consumer on everyday necessities, like groceries and clothing. During a Public Hearing before the Finance Committee, I testified about the detrimental impact of the tax, alongside hundreds of concerned business owners.

These concerns were deflected by the majority party, with an out-of-touch sentiment that most of the tax would be paid by (phantom) ‘out-of-state’ trucking companies. Data is still being collected by the Dept. of Revenue Services (DRS), but the businesses who are attempting to comply have already expressed the undue administrative costs are increasing because of the implementation of the new tax. These are also businesses that are based in Connecticut and primarily operate within our state’s borders.

I, along with my fellow Republicans, sought to make the reporting of this tax more palatable for businesses. DRS ended up extending reporting periods, but despite our efforts to explain that increasing taxes never yields a prosperous business climate, the tax itself remained unchanged by the governor and his legislative partners. To make matters worse for prospective businesses looking to make the Nutmeg state their new home, the legislature passed a handful of unfriendly policies this session.

Our restaurants have had an extremely difficult time remaining open over the last few years, mainly due to the pandemic and its related restrictions. Regardless, the legislature created tougher operational standards for Connecticut eateries to comply with, making it that much more difficult for potential restaurateurs to open new ventures here. Additionally, the legislature moved to eliminate cash discounts at gas stations and removed the ability for retailers to require receipts when refunding gift cards. Should we really be asking more of those who stayed open for us throughout the pandemic?

This recent set of examples is only a snapshot of the zip ties Hartford’s bureaucrats continue to tighten around the private sector. Restricting growth is the exact opposite of what the legislature should be doing. In turn, we should listen to the needs of the business sector and craft supportive policies that foster growth. In that light, I was proud to support a new law that eliminates duplicative business reporting requirements. This was a bipartisan piece of legislation that should serve as a model to how the legislature approaches business-related policy making.

Too much was left on the table this past session. Businesses and taxpayers deserve greater relief. Luckily, some of the proposals that I had been talking about since the beginning of the year ended up being included in the final budget agreement. Income tax relief and implementing a sliding scale on retirement income tax for those who exceed current exemption levels are examples of immediate relief that residents will benefit from. When the legislature moves to make its budget adjustments next year, I will be advocating for more meaningful tax reform.

[1] America’s Top States for Business 2023: The Full List, ‘CNBC.com Staff’ 7/11/2023. https://www.cnbc.com/2023/07/11/americas-top-states-for-business-2023-the-full-rankings.html