Rep. Zawistowski Bill to Increase Tax Abatement for Volunteer First Responders Passes House of Representatives

Posted on May 23, 2019

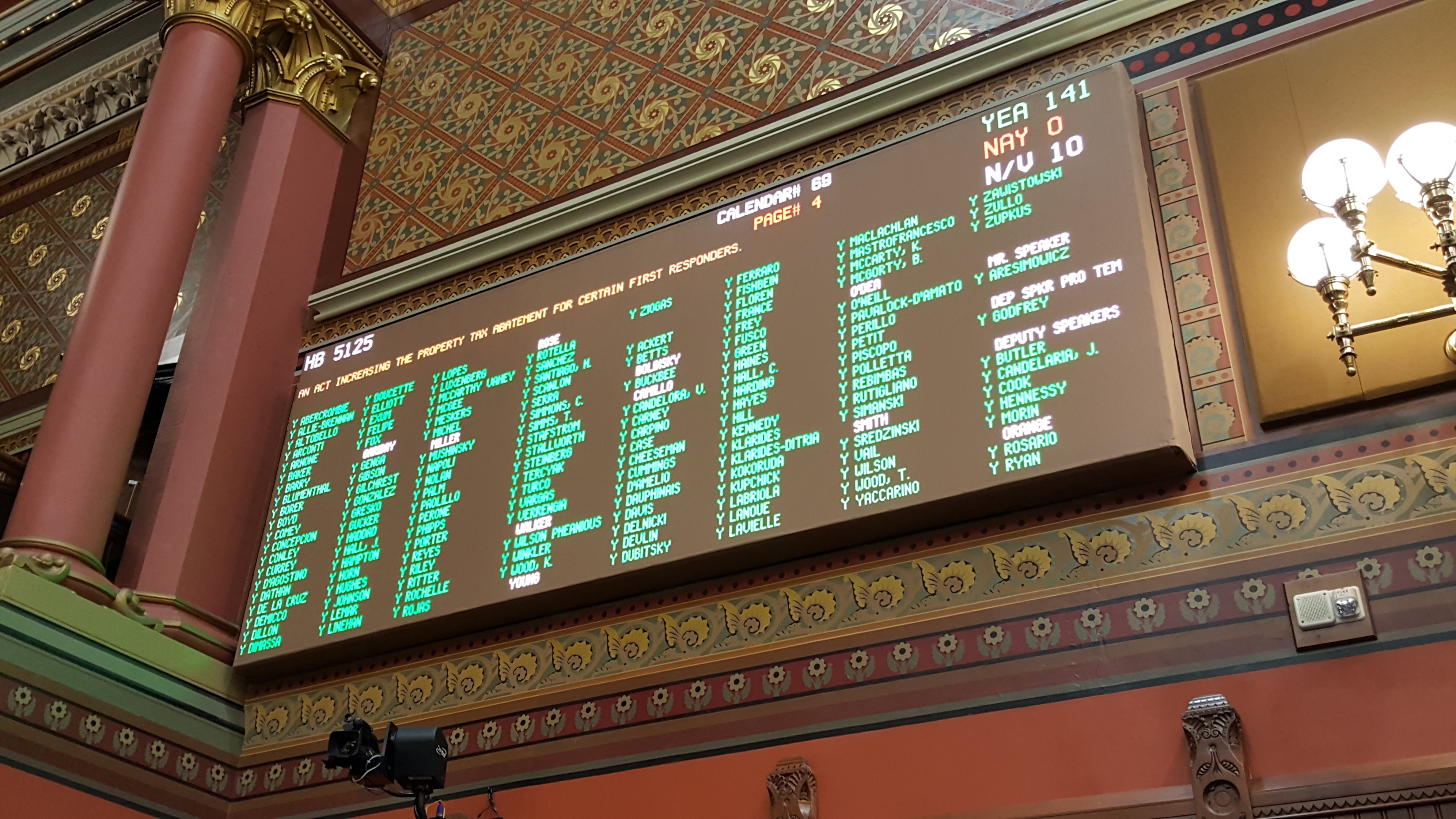

HARTFORD – On Wednesday May 22nd, legislation introduced by State Representative Tami Zawistowski (R-61), HB 5125 ‘An Act Increasing the Property Tax Abatement for Certain First Responders’ was unanimously passed the House of Representatives.

The proposal would allow towns to increase the property tax abatement available to volunteer firefighters and other first responders at a level higher than the current $1,000. Under the legislation the abatement would be scheduled to increase to $1,500 in 2020 and to $2,000 in 2022. This will be optional for towns and would enable them to both attract and do a little more for our dedicated volunteers.

“Many small communities have struggled to attract and retain volunteer firefighters, medical personnel, emergency managers and other first responders,” said Rep. Zawistowski. “This legislation is not a mandate, it simply increases the abatement that towns can offer to volunteer emergency personnel.”

In a public hearing on the legislation East Granby First Selectman Hayden commented, “Most communities, including East Granby, need additional firefighters and other first responders to maintain public safety. An increase in the tax abatement benefit will assist volunteer departments like ours with recruitment and retention along with recognizing the great service that our volunteers provide to their towns.”

Personnel covered by this legislation would include local emergency management directors, firefighters and fire police officers, emergency medical technicians, paramedics, civil preparedness staff and search and rescue.

The bill awaits further action by the State Senate before the end of the legislative session on June 5th, 2019.