Budget Recap

Posted on May 13, 2022

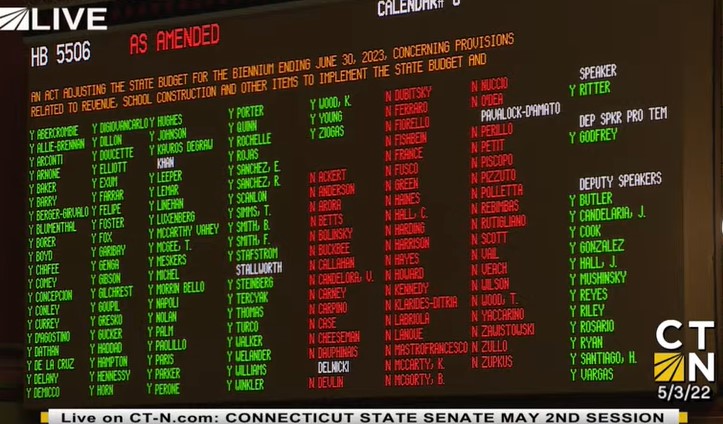

Budget adjustments for the fiscal year ending in 2023 were released around 4:30 a.m. Monday, May 2nd and taken up later that day in the House of Representatives. The budget passed the General Assembly with a near party line vote.

Overall, the package will increase spending by 6.4% over the previous year adding $1.4 billion to the budget. Much of the spending involves one-time allocations setting up fiscal cliffs, and election year gimmicks to support favored constituencies.

Only modest tax relief totaling roughly $600 million is included, most of which is only guaranteed for one year. That relief includes an increased property tax credit to $300 with full eligibility, $250 child tax credit for those making less than $100,000, increased earned income tax credit, capping motor vehicle tax at 32.46 mils.

Republicans offered an amendment which would have provided more substantial broad-based relief. The proposal included reducing the income tax from 5% to 4% for middle- and low-income filers, reducing the sales tax to 5.99%, extending the gas tax holiday and adding diesel, preventing the highway use tax, restoring the property tax credit, and replenishing the unemployment insurance trust fund, among other changes. Ultimately the amendment failed on a party line vote.