Kennedy Supports CT State Budget Agreement **VIDEO**

Posted on June 7, 2023

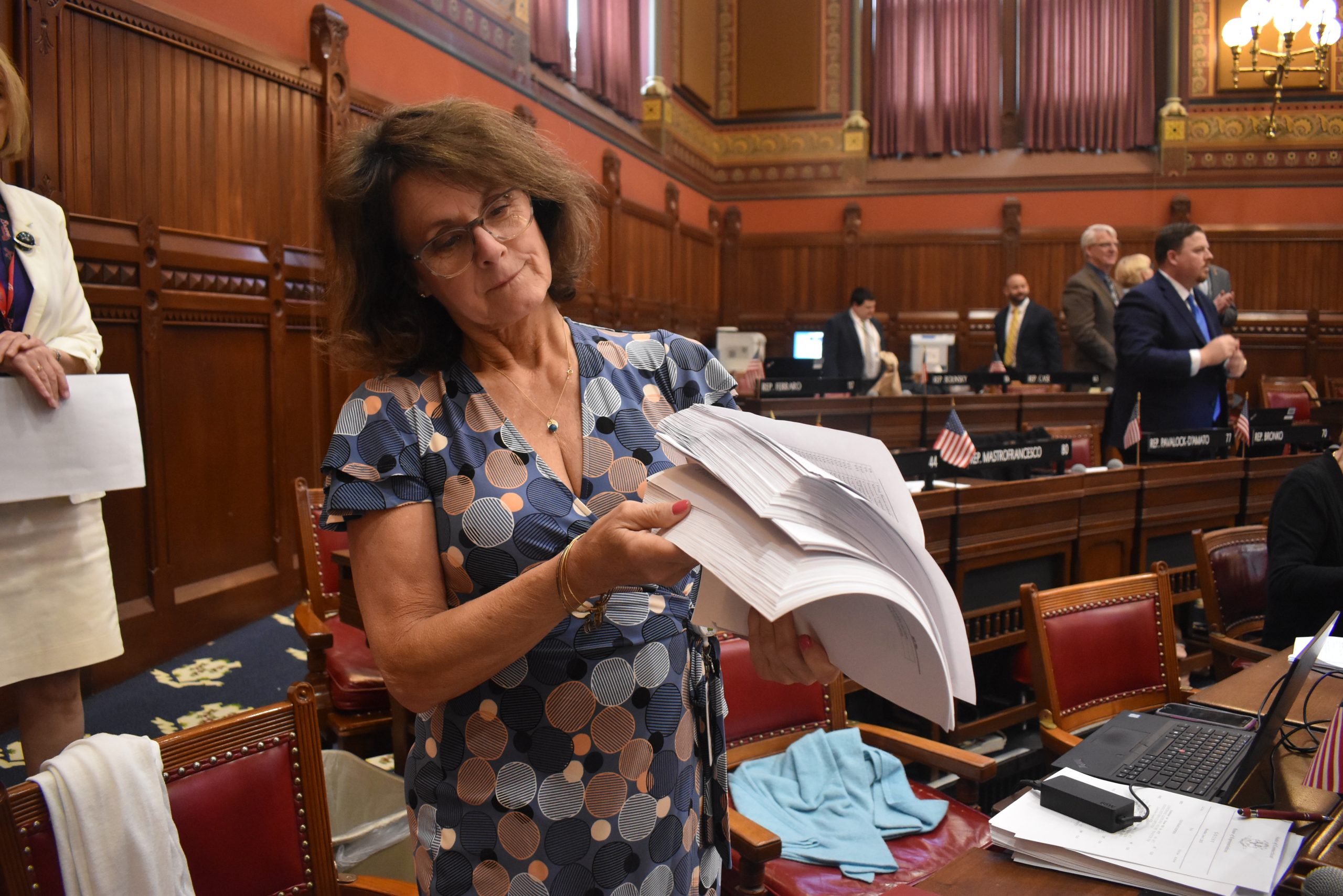

(HARTFORD) — On early Tuesday morning, the Connecticut House of Representatives successfully passed the Biennial State Budget Agreement for Fiscal Year 2024-2025. Classified as House Bill 6941, the 832-page budget document was delivered to legislators’ desks at 3:00AM on Monday morning, giving representatives only a few hours to unpack all its details before casting their final vote.

**BEHIND THE SCENES VIDEO HERE**

The $51 billion budget, spent over the course of two years, adopted several aspects proposed by House Republicans since last spring. Arguably the most important of these is tax relief, decreasing the income tax from 5% to 4% and 3% to 2%, respectively, freezing the diesel tax, and eliminating the “retirement benefits cliff” by phasing out the income tax exemption for pension and annuity income and individual retirement accounts.

Aside from tax relief, other positive budget ingredients include a $150 million education statewide investment, a one-time bonus in funding to non-profits, a student loan reimbursement program for certain CT residents, and a Fallen Hero account that financially supports families of fallen law enforcement officers. More generally, the budget funds Family Resource Centers and school readiness programs, senior meal delivery services, supports resources for victims of domestic and violent crimes, all while abiding by the bipartisan fiscal guardrails that began in 2017.

“Today, I supported the state budget to best represent the interests of the majority of my constituents,” said State Representative Kathy Kennedy (R-119) following Tuesday’s early morning vote. “More specifically, I appreciated how the budget reduces the income tax, increases the Earned Income Tax Credit for working families, provides municipal outreach for the Department of Veterans Affairs, supports training from Firefighter I to Firefighter II and funds the Firefighter’s Cancer Relief Account, and provides the Victims of Crime Act (VOCA) with $30 million for victim’s rights resources, especially related to domestic violence.”

Kennedy added, “However, this bill is not perfect. It does provide relief to our taxpayers, which is something that is sorely needed, but it fails to give long-term aid to our hardworking non-profits. Additionally, this budget did not eliminate the much talked about Highway Use Tax (HUT) but did change the reporting requirements to monthly to quarterly, easing the stress on small trucking and delivery businesses. Finally, this bill also positively froze the diesel tax at 49.2 cents per gallon for one year, but only providing temporary relief as it is not going to be recalculated after fiscal year 24.”

Kennedy concluded, “We must understand that this budget affects all Connecticut residents. The goal of this agreement is to address as many financial needs as possible throughout a fiscal year, which regularly calls for political compromise. Today, I am grateful to Democratic leadership for recognizing and implementing some promising Republican-led proposals, most importantly our push for an income tax reduction, but I call upon my colleagues in the state legislature to recognize that there is still more work to be done.”

For more information on the state budget agreement, or any other state issue, please visit RepKennedy.com or contact Rep. Kathy Kennedy at Kathy.Kennedy@housegop.ct.gov or 860-240-8700.