New Laws Effective January 1st

Key Takeaways

- Many new laws take effect on January 1st, some will affect local control of zoning

I just wanted you to know that several new laws take effect January 1st that could have an impact on you, your business, or our community. I have highlighted some of them below.

An expanded list of those new laws, along with summaries, can be accessed here.

A summary of some new laws includes:

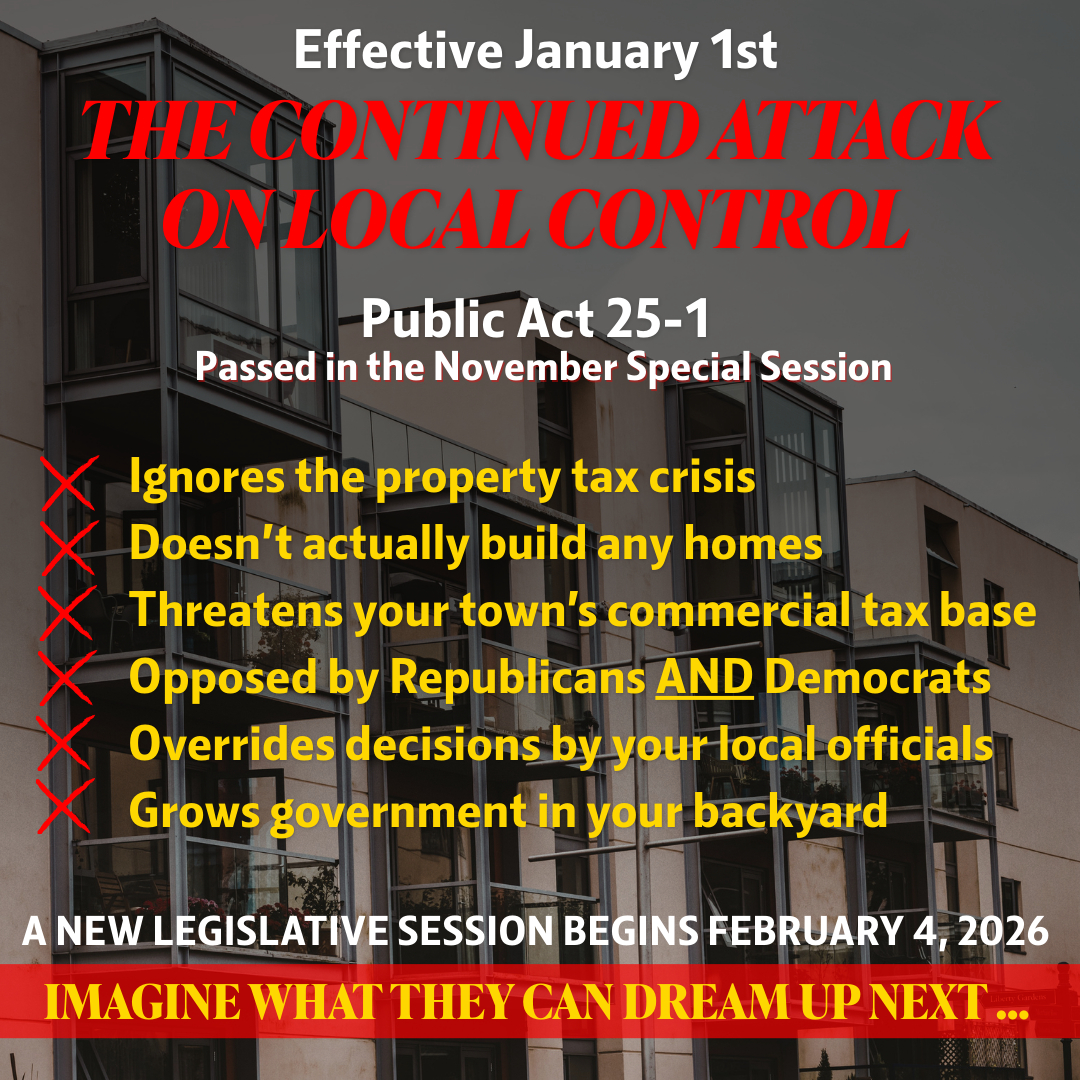

AN ACT CONCERNING HOUSING GROWTH Several provisions of this controversial housing bill take effect on January 1st., including those which attack local planning and zoning decisions.

AN ACT ESTABLISHING AN ALZHEIMER'S DISEASE AND DEMENTIA TASK FORCE, REQUIRING HEALTH INSURANCE COVERAGE FOR BIOMARKER TESTING The provision of the bill taking effect January 1 requires certain individual and group health insurance policies to cover biomarker testing to diagnose, treat, manage, or monitor an insured’s disease or condition.

AN ACT IMPLEMENTING THE RECOMMENDATIONS OF THE DEPARTMENT OF MOTOR VEHICLES This is an omnibus bill covering many topics, but the section taking effect on January 1 implements the Yellow Envelopes Program. The DMV, in consultation with the Commission on Women, Children, Seniors, Equity & Opportunity and other specified entities, must develop yellow envelopes and related public awareness materials for people with cognitive impairments or physical disabilities. Among other things, the envelopes must have written information on how first responders can accommodate and effectively interact with these individuals.

AN ACT CONCERNING PROGRAMMING AT THE DEPARTMENT OF AGRICULTURE AND OTHER FARMING AND AGRICULTURE RELATED PROVISIONS Among other things, this bill increases the mandatory property tax exemption for farm machinery, other than motor vehicles, from $100,000 to $250,000 in assessed value. It also creates a 20% refundable business tax credit for farmers’ investments in eligible machinery, equipment, and buildings that may be applied against the corporation business or personal property income taxes; sets eligibility criteria; requires all or part of the credit to be repaid under certain conditions for five years after the property is acquired.

Other major acts include:

- An Act Concerning Various Measures Recognizing and Honoring the Military Service of Veterans and Members of the Armed Forces in Connecticut

- An Act Implementing the Recommendations of the Office of Higher Education, Expanding Dual Credit Opportunities and Concerning College Readiness and Remedial Support Programs at the CT State Colleges and Universities and Information Reported to the Credential Database

- An Act Concerning the Department of Consumer Protection's Recommendations Regarding Lottery and Gaming Regulations