Buckbee Votes for Full Property Tax Exemption for Disabled Veterans

Posted on April 29, 2024

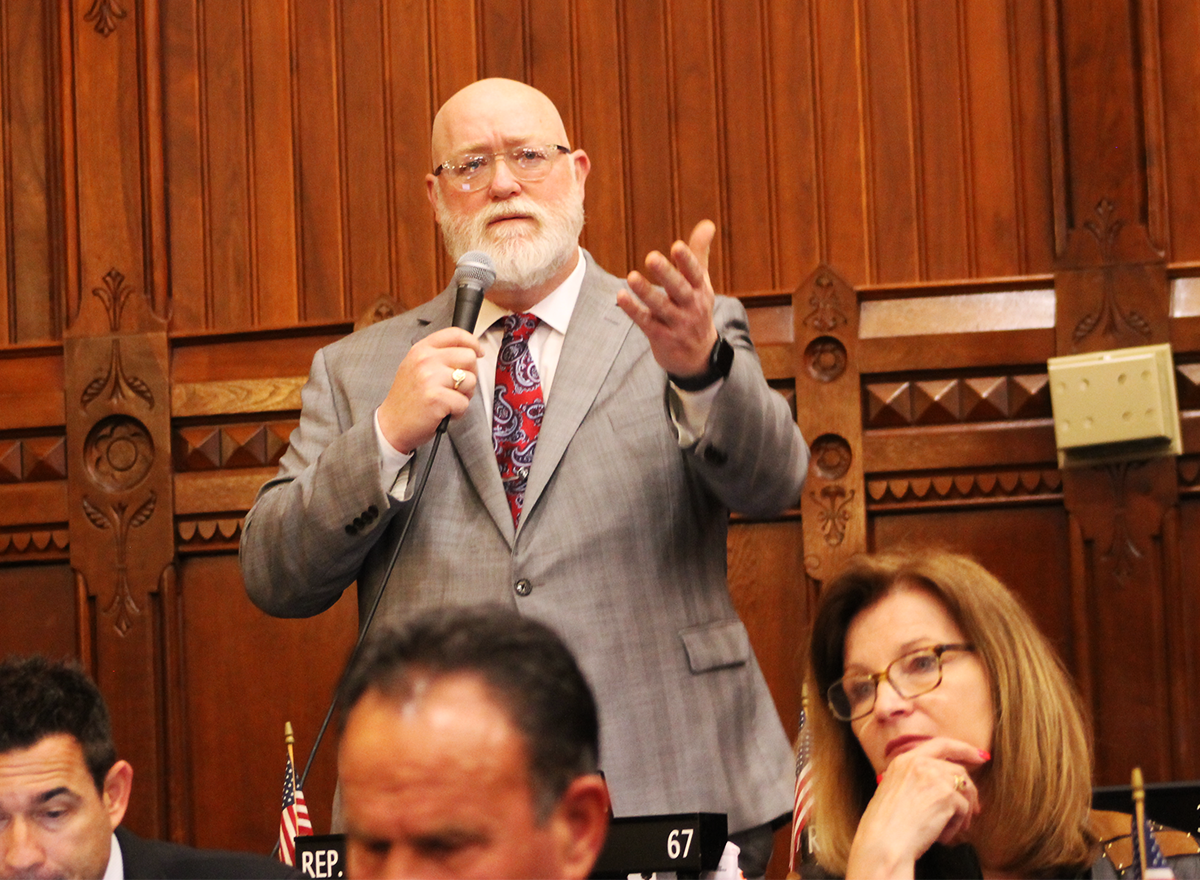

HARTFORD – The House of Representatives acted on H.B. 5491 – An Act Establishing a Property Tax Exemption for Veterans who Have a Service-Connected Permanent and Total Disability Rating. State Representative Bill Buckbee (R-New Milford), who is a member of the Veterans’ and Military Affairs Committee, spoke in favor of the legislation while it was under consideration during Monday’s session.

“This issue really came to light during an open public hearing that was hosted by the Military and Veterans’ Affairs Committee. I want to thank all the veterans who spoke in favor of this idea, as it will help those who gave so much for our state and country. This is a prime example of state government working to create positive policy for the people we represent,” said Buckbee.

View Buckbee’s comments from the floor by clicking here.

The bill calls for a 100% exemption of property tax or motor vehicle tax to those veterans who have a total and permanent disability, which is defined by the U.S. Department of Veterans Affairs. A permanent rating means the department has decided that the service-connected injury will have a long-lasting impact on the rest of the veteran’s life.

To qualify, former service members must have served in the U.S. Army, Navy, Marine Corps, Coast Guard, Air Force, or Space Force; reside in Connecticut; and file for the exemption with their town assessor.

After debate, the legislation was approved through a unanimous vote of 143-0. It now heads to the State Senate for its action. For it to become state law, the Senate must act before the adjournment of the current legislative session, which is set for Wednesday, May 8th.

###