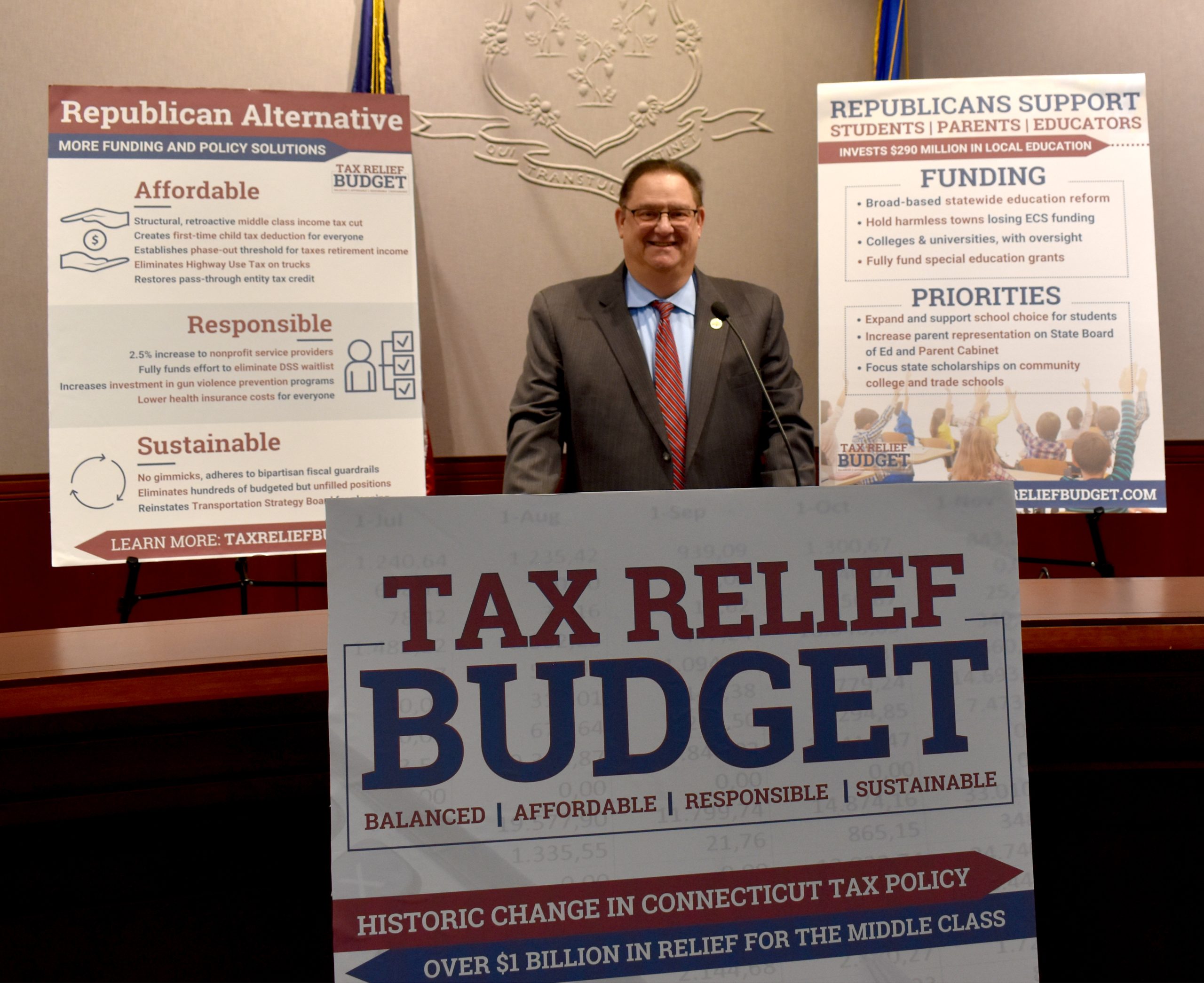

2024-2025 plan provides more tax relief than Governor and Democrats, invests in key areas including education and nonprofit social safety net providers

HARTFORD—State Reps. Mitch Bolinsky (R-106) and Martin Foncello (R-107) along with their House Republican colleagues on Tuesday released a balanced budget proposal that provides more than $1 billion in broad-based tax relief to Connecticut residents while also making historic investments in education and providing more funding for nonprofit providers.

Rep. Foncello said, “This proposed tax and spending plan is aimed at helping the middle-class and to lessen the burden on families. Tax relief is a priority of our caucus and we have proposed a reduction in the income tax rate. There is also help for seniors by allowing them to retain more of their retirement income from social security and pensions. We prioritized easing that fiscal cliff so our long-term residents can age in place. It’s time to give back to the taxpayers of Connecticut and this is a great start.”

Bolinsky said, “Working on Connecticut’s budget has been fascinating this year, especially since we’ll close FY 2023 with a very healthy state surplus. This fact alone is like a double-edged sword that highlights the importance of having multiple perspectives contribute to the process, and how important it is to take a step-back to recognize how we got here, versus the steep deficits faced by Connecticut over the past decade or more. It’s safe to say the defining budget strategy came with the 2017-2018 Bipartisan Budget, and adoption of its “Fiscal Guardrails”, initially proposed by House Republicans and later included through a collaborative process. Constitutional caps on state Spending, Borrowing, and Volatility resulted, curtailing past budget policies that “intercepted revenue” to spend beyond, or “outside”, the budget. In a nutshell, by ‘” spending more than we took-in” past legislatures created perpetual deficits.”

“Our proposed 2024-2025 budget maintains the guardrails and ensures we do not repeat the mistakes that drove past deficits. At the same time, we were able to map a sustainable path to greater investment in critical state services AND return more inflation-driven overcollection of tax dollars back to the taxpayers of Connecticut. Folks can check out highlights from our full proposal below, or link to the full budget here.”

“I’m very proud of the hard work we put into this proposal and look forward to the collaborative process of merging the best parts of the respective budget proposals before us. Governor Lamont has spoken about the importance of the “Fiscal Guardrails”, and his February budget proposal was built to maintain that discipline and cut taxes. Likewise, the Majority’s Appropriations budget contained a lot of good policy, even though it considered some spending “outside” the budget. I believe that the best of all budgets can be leveraged to drive a positive future for all residents of Newtown and Connecticut… Let the talks begin!”

The fiscally conservative plan from House Republicans constrains overall spending growth in the general fund to less than zero percent in FY24 and 2.6 percent in FY25. The Republican plan offers $1.16 billion in tax relief through a variety of means, including a retroactive structural middle-class income tax cut with additional relief for seniors and, for the first time, a state child tax deduction for everyone at a rate of $2,000 per child.

The Republican budget meets the challenge of funding core government services, and in several cases spends more in key areas than Democrats. That includes a $290 million investment in local education funding that provides fully funded special education grants (more than $50 million) for the first time. The budget matches Democrat-level funding for colleges and universities but also installs new reporting requirements for both the UConn and CSCU systems. The plan also provides a 2.5 percent increase for nonprofit service providers.

Summary of Republican Budget & Policy Points

(Download full documentation at taxreliefbudget.com)

Tax Relief for Connecticut Residents

($200 million more than Governor or Majority Appropriations/Finance proposals)

- Adopt but enhance Governor’s income tax cut proposal by using one-time $300 million of FY23 surplus to make it retroactive to January 2023. Removes benefit from top 1 percent earners

- Create first-ever state child tax deduction for all state tax filers, $2,000 deduction per child

- Help job creators by restoring pass-through entity tax credit to 93.01 percent

- Eliminate Highway Use Tax on trucks, a pass-through tax on consumer-goods

- Establish phase-out threshold for state tax on retirement income

- Eliminates sales tax on children’s clothing under $100, 365-days a year

Supporting Students, Parents, Educators

- Invests $290 million in education, including $214 million to implement components of H.B. 5003, $20 million to hold harmless towns with scheduled ECS decreases

- Fully funds special education excess-cost grants ($50 million); funds Danbury charter school ($4 million)

- Expands support for Care4Kids program ($60 million)

- Increases minority teacher scholarship funding by $1 million

- Matches Majority Appropriations budget funding for higher education, but includes oversight

- Increase parent representation on State BOE and Parent Cabinet

General Government

- Increases funding for nonprofit social service providers by 2.5 percent ($100 million)

- Follow real-world hiring pattern in budgeting for open state employee positions, save $200 million

- Fully funds effort to eliminate DSS waitlist

- Increases investment in gun violence prevention programs

- Increases current services funding for rail and bus

- Eliminates proposed messaging program for incarcerated individuals, saving taxpayers $3.5 million

- Enhanced 2-1-1 crisis services for housing and homelessness ($2.4 million)

- Reinstates Transportation Strategy Board to review investments and recommend savings

- Increases pay for assigned counsel in public defender cases ($23 million)

- Expands GPS monitoring for domestic violence offenders ($6 million)

- Increases funding to Women’s Business Development Council to almost $1 million

- Invests in firefighter training, creates $1 million support fund for families of fallen officers

- Doubles Senior Nutrition funding, above Majority Appropriations budget to $3 million

Greater detail at: taxreliefbudget.com