As the novel coronavirus (COVID-19) outbreak continues to make headlines, a great deal of uncertainty has been injected into the lives of business owners and workers, many of whom have been left, indefinitely, without pay or health benefits.

Still, there are many options and resources available to business owners and workers as they navigate these tumultuous economic conditions, and to that end I have dedicated this page to be constantly updated with the newest information for these parties as it becomes available.

As always, if I could be of assistance during this unpredictable time, please do not hesitate to email me at Mitch.Bolinsky@housegop.ct.gov.

Effective Monday, March 23, at 8:00pm, Governor Ned Lamont has ordered all “non-essential” businesses to close in an effort to stop the spread of COVID-19. This does NOT include grocery stores, gas stations, pharmacies, restaurants with to-go menus, and other essential businesses. The full guidance, with a complete list of sectors that are able to stay open, can be accessed by clicking here.

AdvanceCT

On Thursday, March 19th, at 1:00pm, Advance CT held a conference call with Governor Lamont and Department of Economic and Community Development Commissioner David Lehman. They discussed how the state is responding to the economic dimensions of the novel coronavirus (COVID-19) crisis. This call was open to all businesses, chambers of commerce, stakeholders, and other in-state partners. If you missed this call, please click here for a recording.

Families First Coronavirus Response Act

On March 18, 2020, President Donald Trump signed the Families First Coronavirus Response Act (FFCRA), the first of many expected pieces of legislation passed in response to the economic and social impact of the novel coronavirus outbreak. The FFCRA provides paid leave, establishes free COVID-19 testing, protects public health workers, and provides important benefits to children and families. For the official summary, please click here.

Wondering what this could mean for your business? Click here for an FAQ for business owners.

Coronavirus Aid, Relief, and Economic Security Act (CARES Act)

President Donald Trump signed the CARES Act into law on March 27, 2020, releasing trillions of dollars in federal economic and financial assistance to small businesses and families. This bipartisan legislation, among many other actions, expands disaster loan assistance to businesses with options for forgiveness; expands eligibility for unemployment insurance; designates billions more in assistance for distressed states and municipalities; and provides up to $1,200 to individuals and $2,400 to families.

To learn more about what the CARES Act means for your family, please click here. The US Chamber of Commerce has also created a webpage highlighting the provisions of the CARES Act that pertain to small businesses – click here to be redirected.

I will continue to forward information and guidance on the CARES Act as it is made available by the White House.

CT Department of Labor (DOL) Unemployment Assistance

Workers directly affected by the coronavirus pandemic no longer must be actively searching for work to qualify for unemployment assistance. Additionally, employers who are furloughing workers can use the Department of Labor’s shared work program, which allows businesses to reduce working hours and have those wages supplemented with unemployment insurance.

The DOL has also compiled general information for workers and employers who may have questions that arise from the COVID-19 outbreak. A sample of the many questions is pictured below, and you may click here for a full informational guide.

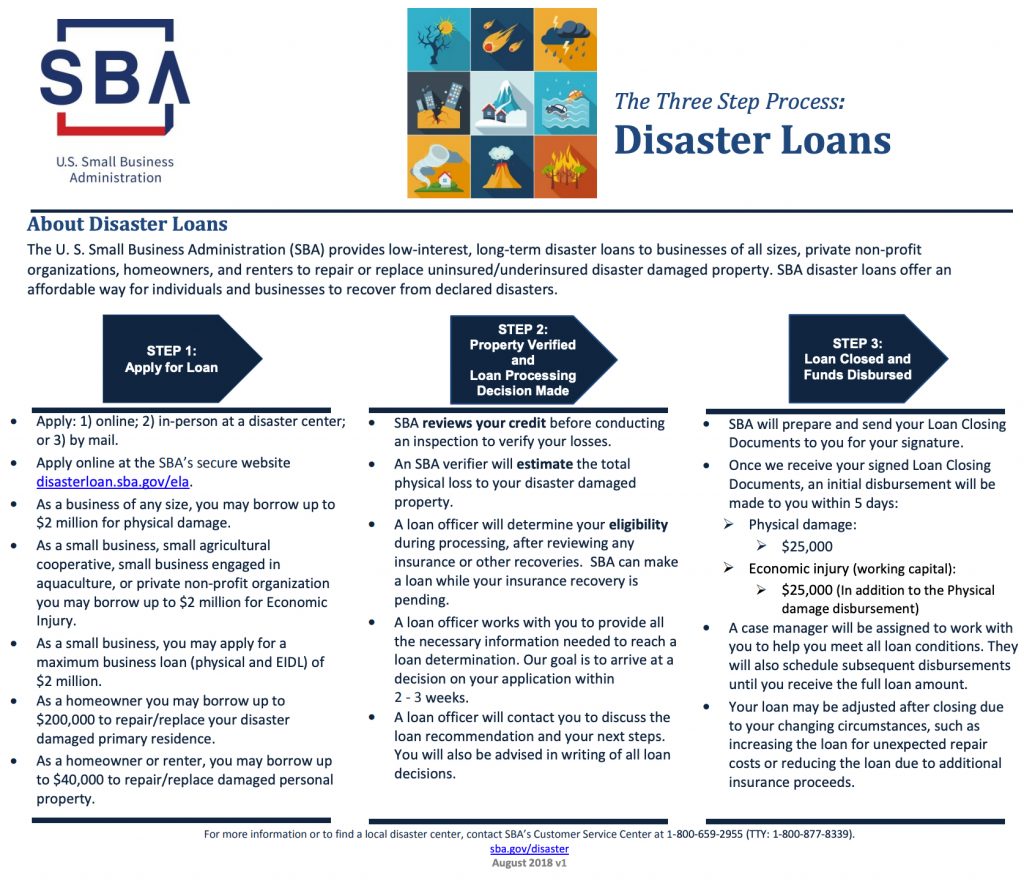

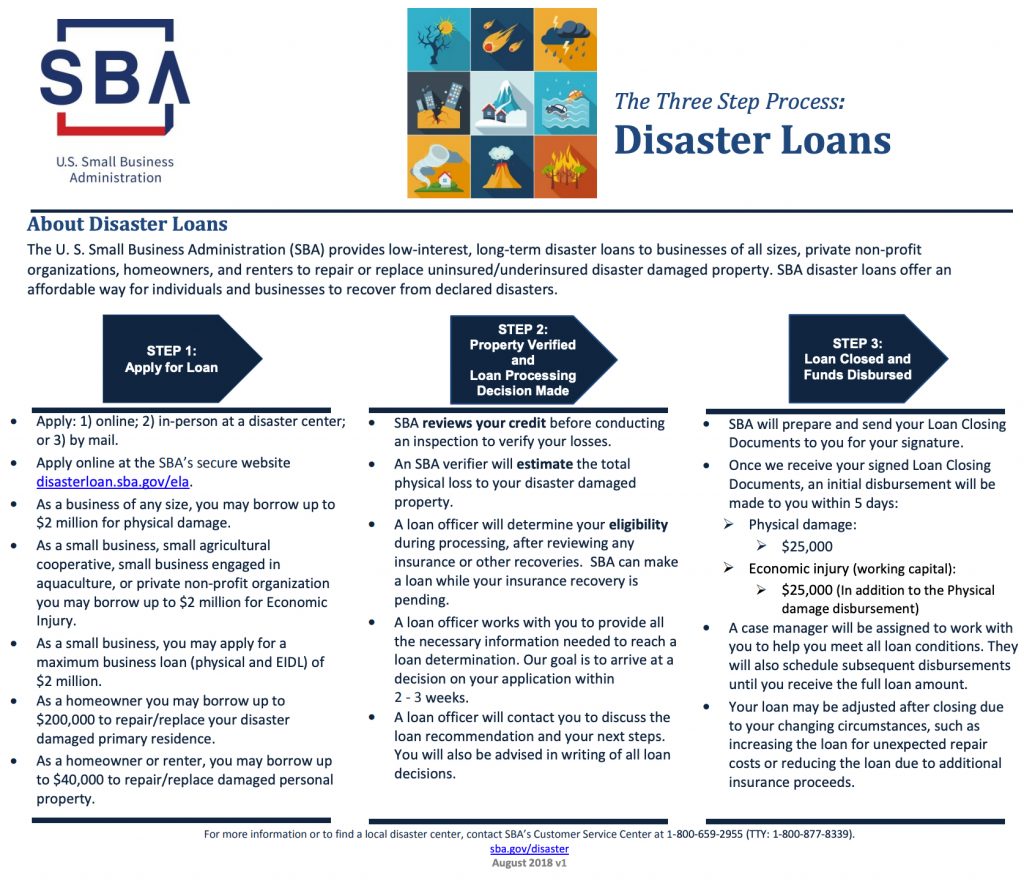

Small Business Economic Injury Disaster Loans

Connecticut small businesses negatively impacted bythe COVID-19 outbreak can now apply for Economic Injury Disaster Loans (up to $2 million) through the U.S. Small Business Administration.

You can learn more about the program and its three-step process in English or Spanish at www.sba.gov/disaster, and begin the online application process here. Or call the SBA at 1-800-659-2955.

Additionally, small business owners with questions about the SBA loan program or other types of state-level assistance can call 860-500-2333 to speak with a representative from the state’s Department of Economic and Community Development.

Visit ct.gov/coronavirus to stay informed about the state’s outbreak response.

LINKS:

CT Department of Revenue Services (DRS) Filing Extensions

The Department of Revenue Services has extended deadlines for filing and payments associated with certain state business tax returns. Details are on DRS’s website.

Funding for Child Care Services

The Connecticut Office of Early Childhood (OEC) announced that funding for OEC-funded child care services will continue through June 30, 2020, a critical step that will ensure child care programs remain financially stable in the wake of the COVID-19 public health emergency. The affected OEC funding streams are School Readiness, Child Day Care, Smart Start, and Care 4 Kids.

In addition, OEC will be releasing up to $4.5 million in Public Health Emergency Response Grant Funds to incentivize and support the operation of public and private programs that provide child care for children of health workers and first responders during the outbreak.

For more information on both these announcements, please visit the OEC’s website by clicking here.

Survey on Business Needs:

Business owners and managers are encouraged to take this survey from Advance CT, the Department of Economic and Community Development (DECD) and the CT Business and Industry Association (CBIA). The information will be used to help the state and policymakers understand the impact of this crisis on CT businesses and how they are responding. The data will help our leaders better assist our business community and the ones they employ.

Resources from the NFIB:

National Federation of Independent Business has set up a website with access to articles, webinars, etc. NFIB advocates for small business at both the federal and state level, and has a strong presence at the State Capitol. The site will be continually updated to reflect any new developments. Click Here.

Resources from the CBIA:

Connecticut Business and Industry Association has also compiled a helpful collection of guidance, resources, and information for employers. Click Here.