Posted on February 15, 2024

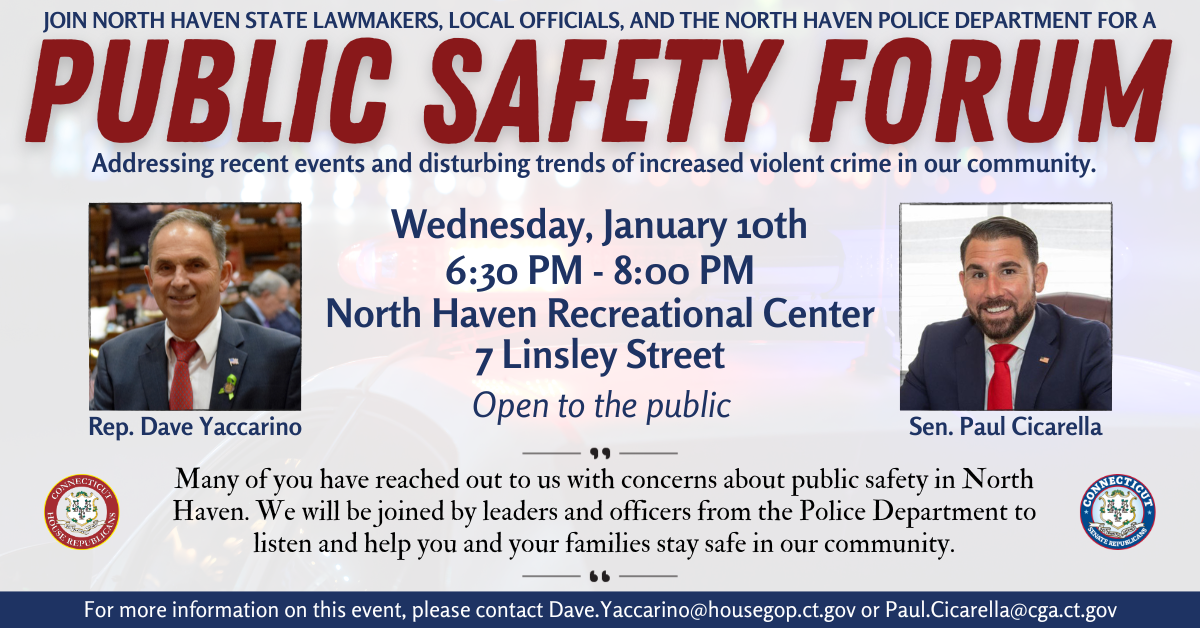

HARTFORD – On Thursday February 16, 2024, State Representative Dave Yaccarino (R-North Haven) led the Executive & Legislative Nominations Committee in a public hearing to further the nomination of Ronnell Higgins as Commissioner of the Department of Emergency Services and Public Protection (DESPP).

“I believe that Governor Lamont made a tremendous choice to nominate Ronnell Higgins as Commissioner of DESPP. His education, experience, and empathy uniquely qualify him to take on the challenges of an…