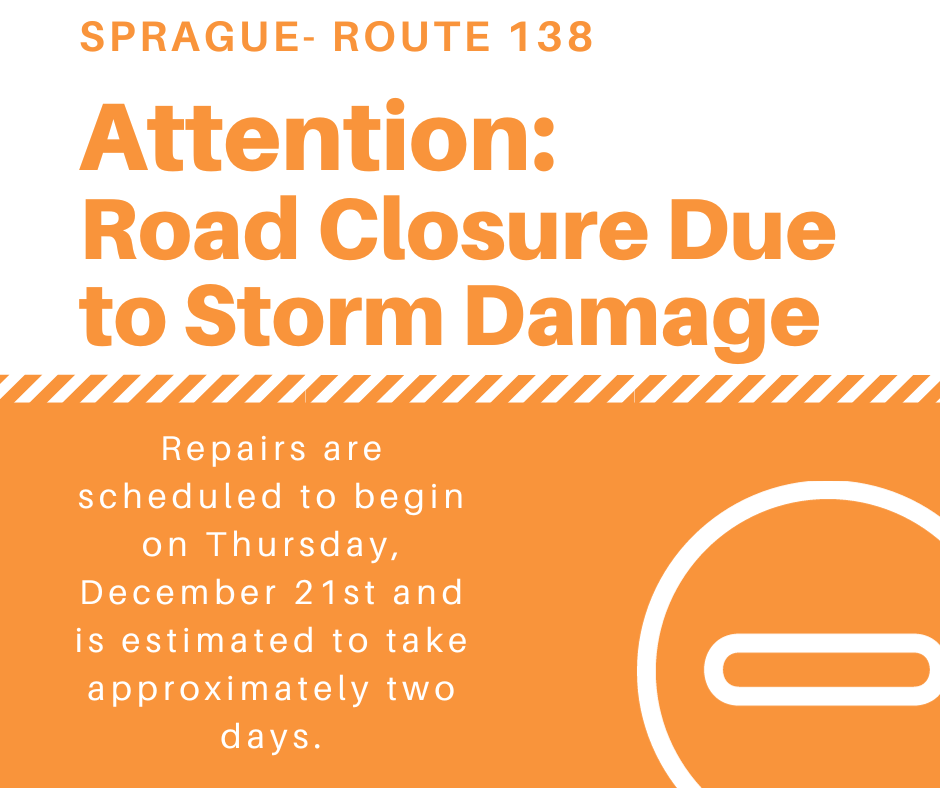

Posted on December 21, 2023

Please be advised that Route 138 in the Town of Sprague is currently closed due to damage from Monday’s storm. The Connecticut Department of Transportation plans to begin repairs on Thursday, December 21st. These repairs are expected to take approximately two days, and paving the road is scheduled to take place on Saturday, December 23rd, according to the CT DOT.

Please seek alternate routes if you are traveling through the Town of Sprague over the next several days, and I will pass along any updates…